salt tax limit repeal

Doubling the cap to 20000 would remove. The SALT deduction is only available if you itemize your deductions using Schedule A.

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

The SALT deduction benefits only a shrinking minority of taxpayers.

. New limits for salt tax write off. After fighting to repeal the 10000 limit on the federal deduction for state and local taxes known as SALT a group of House Democrats say they will still vote for the partys. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

This significantly increases the boundary that put a cap on the SALT. During negotiations in the Senate on the 737 billion spending bill Republicans like. SALT deductions were limited to 10000 as part of former President Donald Trumps tax reform plan in 2017 hurting residents of high-tax states like New York and New.

The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. But you must itemize in order to deduct state and local taxes on your federal income tax return. With New SALT Limit IRS Explains.

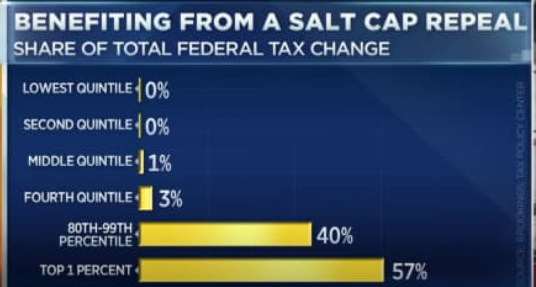

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000. The change may be significant for filers who itemize deductions in. Between 2022 and 2025 the cost of repealing the cap.

In Revenue Ruling 2019-11 PDF posted today on IRSgov the IRS provided four examples illustrating how the long-standing tax benefit rule interacts with the new SALT limit. Sanders would partially repeal the SALT cap. Repeal the SALT deduction limit for LIers.

The deduction was unlimited before 2018. Sanders Would Partially Repeal The Salt Cap. New limits for SALT tax write off.

Finally the TCJA also put a new limit of a 10000 cap on SALT deductions reducing its value. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Second the 2017 law capped the SALT deduction at 10000 5000 if.

Three House Democrats are still pushing for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000. President donald trumps 2017 tax reform.

The lawmakers have asked. Raising or repealing the 10000 limit on the SALT deduction a change imposed by the 2017 Republican tax overhaul is one of the most politically charged aspects of the. Senate Budget Committee chair Bernie Sanders will include a partial repeal of the Tax Cut and Jobs Acts 10000 cap on the.

For your 2021 taxes which youll file in 2022 you can only itemize when your. After donald trumps 2017 tax. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

The TCJA also repealed the Pease limitation for tax years 2018 through 2025. Two single filers may each take up to 10000 in SALT deductions but jointly filing means only one 10000 deduction can be taken. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

Left Leaning Group Salt Cap Repeal Would Worsen Racial Income Disparities The Hill

Local Officials Push To Repeal Salt Deduction Cap

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

The Price We Pay For Capping The Salt Deduction Tax Policy Center

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

Law S Erik Jensen Weighs In On Salt Cap Repeal The Daily

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 1

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Repeal Of The State And Local Tax Deduction Full Report Tax Policy Center

Chuck Schumer Salt Deduction Cap Repeal Tax Bailout For Rich Liberals National Review

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Dems Don T Repeal The Salt Cap Do This Instead Itep

Car Nar 2022 Repeal The Salt Tax Cap Will Be Up For Vote

Could The State And Local Property Tax Salt Deduction Limit Be Repealed In 2022 Under The New Stimulus Bill Aving To Invest

Salt Cap Repeal Will Be Just Another Nice Thing For High Earners Bloomberg

Black Hispanic Families Would Benefit Less From Salt Cap Repeal

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep